“Buying the Dip” on REITs

It is incredible to have witnessed what has transpired in the month of November 2016. Trump’s victory has spurred a complete 180 degree turn in macro thinking. Some of the great macro men like Ray Dalio, Stanley Drunkenmiller and Jeffery Gundlach have discussed what is now openly believed to be a new growth and inflation cycle in the world. A period where interest rates must rise and price in new, much higher inflation expectations.

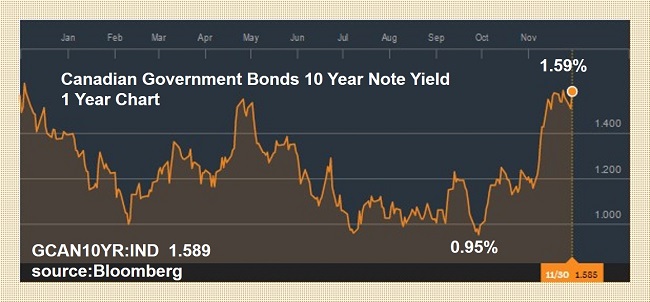

This has spurred one of the largest 1-month multi-trillion dollar selloffs in global bonds, particularly high grade government bonds. Very few countries were spared in the bond route, Canada being no exception as we have seen over a 50% increase in interest rates as seen looking at the benchmark yields on the 10-year Government of Canada bonds (0.95% increased to 1.58%).

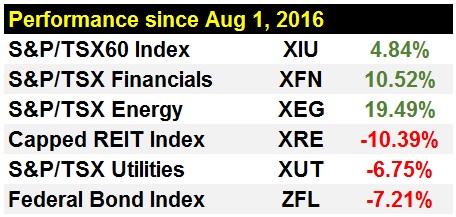

This macro rethink has accelerated a material asset class and sector rotation away from bonds and highly interest rate sensitive equities and into cyclical and financial names. See the sector breakdown below.

So, is this it? The long awaited great rotation that was well advertised over the last 3 years. Are we in the midst of a new and prolonged bear market in bonds?

It is my stance that investors are getting way ahead of themselves believing that it has all turned for good, particularly in Canada. While President-Elect Trump will spur new growth in U.S. economy, it is likely going to be accompanied by considerable uncertainty for Canadians in regards to potential changes in existing trade agreements and new protectionist policies south of the border.

There are two key precipitating factors that could make Canada’s interest rate trends diverge from its current correlations to the U.S.:

- Canada does not have the U.S. style growth and inflation pressures. The OECD (Organization for Economic Co-operation and Development) still anticipates a very modest 1.20% growth in Canada this year and 2.10% next year. This is confirmed by the Bank of Canada that has consistently lowered its growth forecasts quarterly. It is unlikely that this will spur any real inflationary pressures in Canada.

- There are divergent monetary policies between the Fed and the BoC. While the Federal Reserve is positioning to raise, and normalize interest rates, the Bank of Canada is far more dovish and accommodative.

So, let me build you an alternate narrative. What if November’s bond crash is over? What if Canadian interest rates remain low in Canada, even if they are rising in the U.S.?

If that comes to fruition, it may prove a scenario where the cyclical and financial stocks are priced to perfection and the interest rate sensitive REITs, Utilities and Bonds are oversold and represent a compelling risk adjusted return.

To say the least, if you warm up to this story, you have to consider yourself a contrarian because you will find very few share that perspective right now. That makes the “buying the dip” a stressful proposition. This is where one can utilize an options strategy to potentially enter a position.

Let’s look at the REIT index as an example:

Our investor is prepared to potentially buy a longer-term position in the iShares S&P/TSX Capped REIT Index Fund (TSX:XRE) but is uncertain if this is the right time to buy it on the dip. Our investor is looking for a strategy to secure a fixed purchase price while giving the investment several months of time to see how the markets settle down into the new year.

- Investor is looking to buy a 2000 share, $30,000 investment into the ETF

- XRE is trading at $15.42 on November 30th, 2016

- The January 20th, 2017 $15.00 call is asking $0.70

- The option has a $0.42 intrinsic value and $0.28 time premium cost (1.82%)

Our investor buys 20 contracts of the January $15.00 call options for $1,400.00 (20 x100x $0.70). This secures the right to be able to buy 2000 shares at the guaranteed $15.00 price (currently $15.42). With a $0.70 per share cost, if exercised would give the investor and average cost base of $15.70 ($15.00+$0.70).

What has our investor created? A situation where they have about 2 months to decide if they want the shares or not. If the perspective that this is a “buy on dip” is proven early and the ETF continues to slide lower and lower in price, our investor simply walks away with the maximum loss being defined to the premium paid for the calls.

Alternatively, if proven correct and the REITs rebound higher proving to be an opportune price level, our investor will exercise their right to buy the ETF shares at $15.00 and take on the 2000 shares for a long-term investment.

In a period of considerable volatility and uncertainty, paying a modest premium to time the entry on your investment may be a worth while expense.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.