Delta: Assessing Probabilities Based on the Break-even price

As we saw in an earlier article, delta measures how much an option’s price moves in relation to a change in the price of the underlying asset. Delta is a variable from the Black-Scholes option pricing model, and it is also used in the industry as an approximation of the probability that the option will be in-the-money at expiration.* So we say that a deep in-the-money option, i.e. an option with a delta of close to 1, has an almost 100% chance of being in-the-money at expiration. A deep out-of-the-money option, with a delta close to 0, will therefore have an almost 0% chance of being in-the-money at expiration. And an at-the-money option, with a delta close to 0.5, will have a close to 50% chance of being in-the-money at expiration.

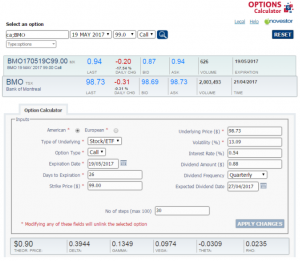

Now consider the following example, taken from the Montréal Exchange’s Options Calculator.

As we can see, the call options BMO 170519 C 99.00 have a theoretical value of $0.90 and a delta of 0.3944. We can say that the probability that this call option will be in-the-money at expiration is approximately 39.44%, and it will be worth at least $0.01. But if I have paid $0.90 for the option and it is only $0.01 in-the-money, I will incur a loss of $0.89 on my option. What I would like to know, at the time that I buy my call option, is the probability that it will turn a profit at expiration, i.e. that it will be worth more than my break-even price of $99.90 (the $99 strike price plus the $0.90 premium).

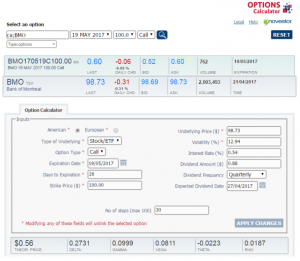

To find this probability, all we need to do is find the delta of a call option with a strike price of $99.90. This particular strike price is not available among the strike prices listed on the Montréal Exchange, so we will interpolate an answer based on the closest strike price, which is $100.

As we can see, the call option BMO 170519 C 100.00 has a delta of 0.2731, for a 27.31% probability of being in-the-money at expiration. Based on the available data, we can find the approximate delta of a theoretical call option with a strike price of $99.90 — our break-even price — as follows. Note that since the specific strike price of $99.90 does not exist (it is not traded on the markets), this exercise only allows us to estimate the probability of our strategy succeeding.

Distance between the benchmark strike prices: $1 ($100 – $99)

Difference between the deltas: -0.1213 (0.2731 – 0.3944)

Difference between the break-even price and the lower strike price: $0.90 ($99.90 – $99.00)

This difference represents 90% of the distance between the benchmark strike prices ($0.90/$1.00)

The delta we are looking for is obtained as follows:

[(4) 90% x (2) -0.1213] + [delta of the lower strike price] 0.3944 = -0.10917 + 0.3944 = 0.2852

Consequently, we can say that by buying the call options BMO 170519 C 99.00 at $0.90, our chances of realizing a profit are approximately 28.52%. We know that there is a 39.44% probability that the price of BMO will be greater than $99. We can therefore say that there is a 60.56% probability (1 – 0.3944) that the price of BMO will be below $99. This means that there is a 60.56% chance that we will incur a total loss. So we now have several important pieces of information for determining whether our chances of success are good enough, and whether our objectives for the underlying asset are realistic in the long term. This is a procedure that can be used to approximate the probability of realizing profits in all our strategies, from the simplest spreads to the most complex.

Good luck with your trading, and have a good week!

* Even though delta is used as a good approximation of the probability that the option will be in-the-money at expiration, there is another variable that provides us with this probability, and with greater precision. We use delta because it is easy to obtain from the most frequently used options software applications.

Black-Scholes formula for a stock option1 c = S0 * N(d1) – VA(K) * N(d2)

1 American or European-style stock option on stocks that do not pay dividends prior to the expiry date of the option.

Where:

c = Value of the stock option

S0 = Current price of the underlying asset

VA(K) = Current value of the strike price

N(d1) and N(d2) are functions of standard normal distribution giving the probability that a normally distributed variable will be less than d1 and d2.

N(d1) represents delta, and N(d2) represents the probability that the option will be in-the-money at expiration. Generally speaking, an option’s delta will be higher than the probability of it being in-the-money, and this spread becomes wider with a longer time to expiration and with higher volatility in the price of the underlying asset.

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

President

Monetis Financial Corporation

Martin Noël earned an MBA in Financial Services from UQÀM in 2003. That same year, he was awarded the Fellow of the Institute of Canadian Bankers and a Silver Medal for his remarkable efforts in the Professional Banking Program. Martin began his career in the derivatives field in 1983 as an options market maker for options, on the floor at the Montréal Exchange and for various brokerage firms. He later worked as an options specialist and then went on to become an independent trader. In 1996, Mr. Noël joined the Montréal Exchange as the options market manager, a role that saw him contributing to the development of the Canadian options market. In 2001, he helped found the Montréal Exchange’s Derivatives Institute, where he acted as an educational advisor. Since 2005, Martin has been an instructor at UQÀM, teaching a graduate course on derivatives. Since May 2009, he has dedicated himself full-time to his position as the president of CORPORATION FINANCIÈRE MONÉTIS, a professional trading and financial communications firm. Martin regularly assists with issues related to options at the Montréal Exchange.

6 Comments

Leave a Reply

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.

Okay,

I must be missing something as the option May 19th $99 Call is the option you priced out. Isn’t the delta of that option as calculated at .2731 mean you have about a 27.3% chance of the call being worth at least $0.90 at expiration?

oops meant to say the delta as calculated is .3944 so the odds of BMO being worth $99.90 at expiration is 39.4%

We are using the delta as an approximation of the probability of the option to finish in-the-money at the expiry date, which is the probability for that option to be worth at least $0.01 at expiry. Therefore, it means that the probability for BMO to be worth $99.01 or more is 39.44%. Now if I want to know the probability for BMO to be worth more than $99.90 (my break-even point) I need to compute the delta of an option with a $99.90 strike price which is what I did in the rest of the article. The final answer is 28.52%. I hope this is helping you.

It did, now I understand. Interesting way of calculating the odds of a position paying off.

Thanks for the reply

Martin, your interesting calculations reminded me of chuck hughes 1% breakeven readings he derived with his profit calculator (on youtube). I think that it is very useful, is it easy to set that up?

Hi, The option calculator can be found at that URL: https://www.m-x.ca/marc_options_calc_en.php

Regards, JP