Of Mice and Men and Rolling Options

As anyone who has every traded knows, the best laid plans often go awry. Before making any adjustments, the investor needs to dissect what went wrong. Does he or she still hold fast to their original forecast but has simply run out of time, or was the strategy selection itself incorrect? Remember that closing the position in full or cutting down the size of the position are always valid choices.

Before questioning your ability to trade options, know that managing the position is as important as getting the forecast right. While it’s very satisfying to have the outcome perfectly match the investor’s initial forecast, it is safe to say that this won’t happen with each position. Those investors who learn to adapt to changing market conditions will give themself a better chance of long-term success.

The basic tenants of trading and investing begin with understanding the potential losses as well as the profits. When losses occur, it is critical for each investor to know well ahead of time where that proverbial line in the sand is, and when to cut losses. Another important component to trade adjustments is to have enough available funds to be able to make those adjustments. There may be several motives to roll your option(s), but the most common reasons are to avoid assignment for short options, buy more time, add or reduce leverage, or adjust the overall break-even point of the strategy. Remember that in most cases, you are closing the initial position thus establishing a loss, and looking to recover the loss in part or in full by adjusting the position “up” to a higher strike or “out” further into the future.

Let’s look at an example:

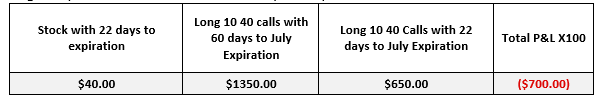

The investor begins with a bullish forecast on XYZ stock currently trading at $39. With 60 days to expiration the investor purchases 10 July $40 strike calls at C$1.35 for a total of C$1350.00. The break-even point is $41.35. With 22 days to go to expiration and the stock virtually unchanged, the July $40 calls are trading at 65 cents.

Long 5 July 40 calls at 60 cents with 22 days to Expiration

This investor maintains his bullish forecast, but does not wish to contribute more capital to replicate the original position, but needs more time for his original forecast to pan out. The calls are sold generating a C$700 loss and the remaining proceeds of position, C$650.00 are used to purchase 5 August $40 calls at C$650.00. A new position is established for even-money, not including commissions. The investor remains long and buys additional time for the bullish strategy to work, and has reduced his overall leverage.

Long 5 August $40 calls at C$1.30 for a total C$650.00 with 57 days to Expiration

Roll from July Expiration out to August Expiration

Sell 10 July $40 calls at 65 cents +$650.00

Buy 5 August $40 calls at $1.30 –$650.00

00.00

The new break-even point of the rolled strategy is $41.30. Here’s how you calculate a new break-even point after a roll of an existing position:

- Take your net investment amount after the roll, which may be the same if roll is done for even money, reduced if done for a net credit, or increased if done for a net debit

- Divide this amount by the number of contracts in the new position

- Divide this amount by the $100 contract multiplier and add to the strike price of the option.

To calculate the total break-even at expiration including earlier loss:

- Take the earlier loss of $700 divide by the new contracts x multiplier (5×100) to get needed additional increase in value for each option=$1.40

- Add this value to the break-even option value of $1.30 of the new position for a total value of $2.70

- The $2.70 option price is added to the roll break-even of stock $41.30.

- The stock price at expiration, at which the investor would recover his earlier loss, is now $44.00.

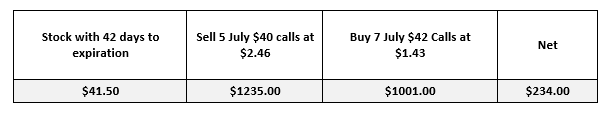

Another example of a roll involves moving a long call to a higher strike rather than going out in time. Here the objective is to increase leverage and have the opportunity for greater profits by adding additional call options.

In this scenario, the investor is long 5 August $40 expiry calls at $1.30 or C$650.00. With 42 days to go and the stock trading at $41.50 the calls are sold at $2.46 each for a total of $1,235.00, and 7 August $42 calls are purchased for $1.43 for a total of $1,001.00. The investor now has a locked in profit of $234.00 while increasing his leverage by 2 contracts. A stock price of $43.43 becomes the new break-even point.

Final thoughts: There are as many different ways to roll options, as there are objectives and tolerances for risk. Just like sailing, investing requires that you need to make changes in your course appropriate to changes in the wind. Options give investors many ways to adapt to changing market environments. Note also, that there are no guarantees that rolling the position will achieve the desired outcome. In some cases you could compound earlier losses.

CEO

Grigoletto Financial Consulting

Alan Grigoletto is CEO of Grigoletto Financial Consulting. He is a business development expert for elite individuals and financial groups. He has authored financial articles of interest for the Canadian exchanges, broker dealer and advisory communities as well as having written and published educational materials for audiences in U.S., Italy and Canada. In his prior role he served as Vice President of the Options Clearing Corporation and head of education for the Options Industry Council. Preceding OIC, Mr. Grigoletto served as the Senior Vice President of Business Development and Marketing for the Boston Options Exchange (BOX). Before his stint at BOX, Mr. Grigoletto was a founding partner at the investment advisory firm of Chicago Analytic Capital Management. He has more than 35 years of expertise in trading and investments as an options market maker, stock specialist, institutional trader, portfolio manager and educator. Mr. Grigoletto was formerly the portfolio manager for both the S&P 500 and MidCap 400 portfolios at Hull Transaction Services, a market-neutral arbitrage fund. He has considerable expertise in portfolio risk management as well as strong analytical skills in equity and equity-related (derivative) instruments. Mr. Grigoletto received his degree in Finance from the University of Miami and has served as Chairman of the STA Derivatives Committee. In addition, He is a steering committee member for the Futures Industry Association, a regular guest speaker at universities, the Securities Exchange Commission, CFTC, House Financial Services Committee and IRS.

2 Comments

Leave a Reply

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.

I do not follow the Break even point calculation in the first case. Whether loss or not, the total premium paid by the hedger is only 1350 (not including transaction charges). So, the breakeven point is 1350/500 (new number of contracts x100)=$2.70 above new Aug Strike price of $40 = 42.70 and not $44.00

Very good question indeed.

The total premium paid on options is $1 350.

Because we did roll over (from July 10 calls to August 5 calls options), no new premium added.

Then the break even of the whole strategy is: (Total premium / 500 shares (5 August calls remaining)) + Strike Price

= $ 1350 / 500 = 2.7 $2.70 + $40.00 = $42.70